Your credit score is calculated after comprehending various variables. These include payment history, the total amount owed in liabilities and the number of credit accounts held by you, among other factors. The bottom line of a credit score is that it is your financial reputation.

A good credit score makes it easier for you to obtain fresh sources of credit from lenders. Additionally, you may be paying lesser interest to lender companies on loans, if you have a good credit score. In fact, even the approval of a loan from a bank depends on your credit score.

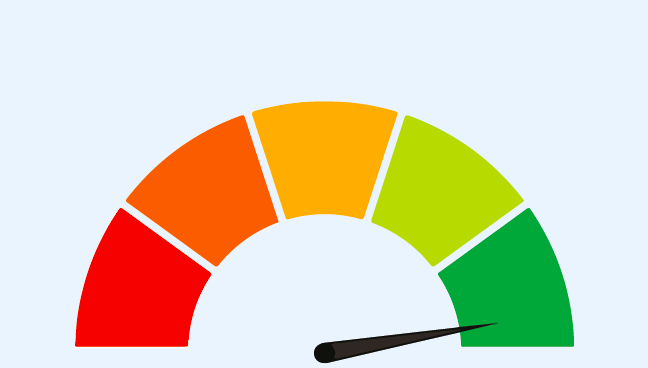

So, every time you want to apply for credit card or a loan, the lending company may want to check your credit score. This score represents your credit risk at a given point of time, based on credentials drawn from your credit report. Let us discuss the credit score ranges prevalent in India.

Various Credit Score Ranges

Between 800 – 850: Exceptional Score

If your credit score is here, you are regarded as a highly responsible person when it comes to finances. Any lending institution will consider you to be a prime candidate and will be readily willing to lend credit. Moreover, the applicable rates of interest on your borrowings will be the lowest.

The only way that you will be able to achieve a score in this range is when you have a long credit history. Though never being late with your payments, and avoiding low balances on your cards is vital to push the score to these levels.

The reason why the applicable rates of interest on your loans, credit cards and mortgages is lower than usual is that the lending institution finds you to be a reliable candidate, who is unlikely to default on their agreement to make payment.

When you want to take up an additional loan, you will find that it is easier to obtain when you have a credit score in this range.

Between 740 – 799: Very Good Credit Score

Next, after the first range of credit score is the excellent credit score range. If you manage to find yourself in this range of credit score, the general perception about your financial standing will be that you are a financially responsible person. The lending companies will find you as someone who understands credit management and practices the same.

You will be able to achieve this range of credit score only by making timely payments for your dues. This includes payments for loans, utility items, credit cards, rents and more. Compared to your credit limit available, the balance of credit card should be maintained at a low level.

Between 670 – 739: Good Score

If you manage to earn a credit score between this range, you will have a good credit score. Since your credit score is below the above two ranges, you may be able to negotiate a deal for competitive rates of interest. However, you are unlikely to grab a lucrative rate as good as the above two categories.

Moreover, lending companies may not offer all types of credit options to you either. These include specific premium offerings such as credit cards, which are reserved only for those who have a superior credit score.

In addition to this, you may need to look around for some good options when you want to avail an unsecured loan.

Between 580 – 669: Fair Credit Score

This is the average category and finding yourself in this range is not the best for you. Although there is no major tainting on your credit history but the fact that you are standing in this credit range means that you have some issues with your history.

Any lending company may be willing to extend additional credit to you but only at their chosen rates of interest. You will not be in a position to negotiate for a better term with them.

Although your options tend to become limited at this stage, you will still be able to find some likely ones when you need additional credit.

Under 500: Poor Credit Score

If your credit score lies between the range of 300 and 579, you will be considered as an individual with a damaged credit score. You are most likely to find yourself in this credit range when you have defaulted on payments of your credit sources multiple times.

Bankruptcy is another reason why you may find yourself in this credit range. Moreover, it is likely to remain on your record for no less than ten years. You will find it very difficult to obtain new credit if your existing score is at this level.

A damaged credit score warrants repair, which can be done through the following methods:

- Start reviewing your credit reports and check your credit scores to ensure that nothing on the report is faulty.

- Open a dispute if you believe that a negative remark on your credit report is unworthy.

- If you find entries for your credit cards or loans in negative, you can open a dispute in case they were made erroneously.

- Consult a specialist to help you get back on the side of a good credit score.

- If you are using a credit card, go for a low credit card balance which will help to impact your credit score positively.

- Search for credit cards which are specifically meant for those who wish to repair their credit image. Consider making timely payments on this account to improve your credit score.

- Use asset derived income from paying down balances, which will give a boost to your credit scores.

- Always choose to pay off high-interest credit accounts before anything else.

In Conclusion

Maintaining a good credit score is a function of capable financial decisions and a knack for credit management. Often, people seek the credit card for online shopping without understanding the financial repercussions that it brings with it.

So, it is essential to understand the operation of credit score ranges and how your financial decisions impact your score. If you maintain a good credit score, you will be able to obtain new credit easily and without any hassle.

- Featured Image [Right click and choose “Save Image As…” to download the image]